Exploring China: how digital transformation is shaping inbound tourism

Dear reader,

We recently returned from the GNTB’s Digital Travel Knowledge tour to China, where we were joined by 17 experts and decision-makers from the German tourism industry. Parts of the tour were accompanied by a parliamentary delegation led by Gülistan Yüksel, Deputy Chairman of the Tourism Committee of the German Bundestag, and Dieter Janecek, Federal Government Coordinator for the Maritime Industry and for Tourism.

Our trip at a glance: 7 days – 4 cities – lots of meetings with leading technology and tourism firms and an incredible amount of insights, inspiration and personal experiences.

As many of you are aware, the GNTB functions as a hub for Germany’s inbound tourism industry, drawing on its knowledge of the global market and its network to help SME partners to gain access to markets and cofinance business deals. During the GNTB’s tour to China, our representative office in Beijing used its contacts to arrange high-level meetings with the top technology and tourism firms in China’s largest cities. This Sino-German dialogue focused on topics such as AI, the Internet of Things, robotics, big data and autonomous mobility. Data monetisation, a commitment to AI-driven innovations, and the IoT are revolutionising the travel industry. Of course, aspects such as data protection, cybersecurity and the accompanying regulations mean that many different systemic approaches and challenges are in play.

But if we want to continue to participate in high-growth markets for tourism, including China, we and our partners in the German travel industry must press ahead with implementing digital services along the entire tourism value chain.

I would like to now share with you how we view one of the world’s most exciting markets for tourism. Here are the key points:

1. Market signals need to be identified at an early stage, analysed and strategically exploited

China’s economy has undergone a remarkable transformation in the last few decades. This economic boom means that the country has also emerged as an important source market for global tourism.

As the national tourist board for Germany, we identified the potential of this enormous market very early on. Back in 2001 – in connection with the first agreement on Authorised Destination Status – we presented the Delegation of German Industry and Commerce in Beijing with a market outreach request in order to actively position Germany as a travel destination in the Chinese market.

Chinese outbound tourism to Germany became a success story for the German market over the course of the next two decades. In 2018, Chinese guests notched up more than 3 million overnight stays in Germany for the first time – making China by far the most important source market for us in Asia.

In 2024, there are a number of different reasons to consider the Chinese market even more closely and from new perspectives:

- The desire to travel post-Covid is extremely high and the gap between pre-and post-pandemic travel figures will close in the near future.

- The travel patterns of Chinese visitors are changing: trips that offer sustainability, culture and authenticity are gaining in popularity over the whistlestop multi-destination tours of the past.

- Demand for independent travel is growing more strongly than for group travel.

- China’s pioneering role in technology provides impetus for the travel industry worldwide – I believe that this is one of the most important reasons to examine the Chinese market in more detail.

The GNTB Open Data/Knowledge Graph project provides a key foundation for ensuring that Germany remains a favourite travel destination for tech-savvy travellers looking for both tradition and innovation.

2. The economic boom in China is reflected in its consumer spending and appetite for travel – China’s explosion in tourism saw it become the no. 1 growth market for travel in the 2000s and 2010s

I believe that China, the world’s second-largest economy, is a particularly good example of how closely tourism and economic prosperity are linked. There are various ways of showing this. Take, for example, the eight-fold increase in annual per capita income since 2000, from just over 6,260 yuan to 49,283 yuan. The rapid growth of the economy gave rise to a middle class for whom travel became affordable, and even became a status symbol. The number of outbound Chinese travellers tripled from 48 million a year to 155 million a year between 2009 and 2019.

According to the China National Tourism Administration (CNTA), 60 per cent of outbound travel in the 1990s comprised business trips, but by 2010, the proportion of private trips had already risen to 80 per cent – more clear evidence of the links between the economic boom, the improvement in people’s financial situations and the desire to spend and travel. Despite this rapid growth, the relatively low level of international travel among the Chinese population as a whole still offers tremendous potential compared with European or North American markets.

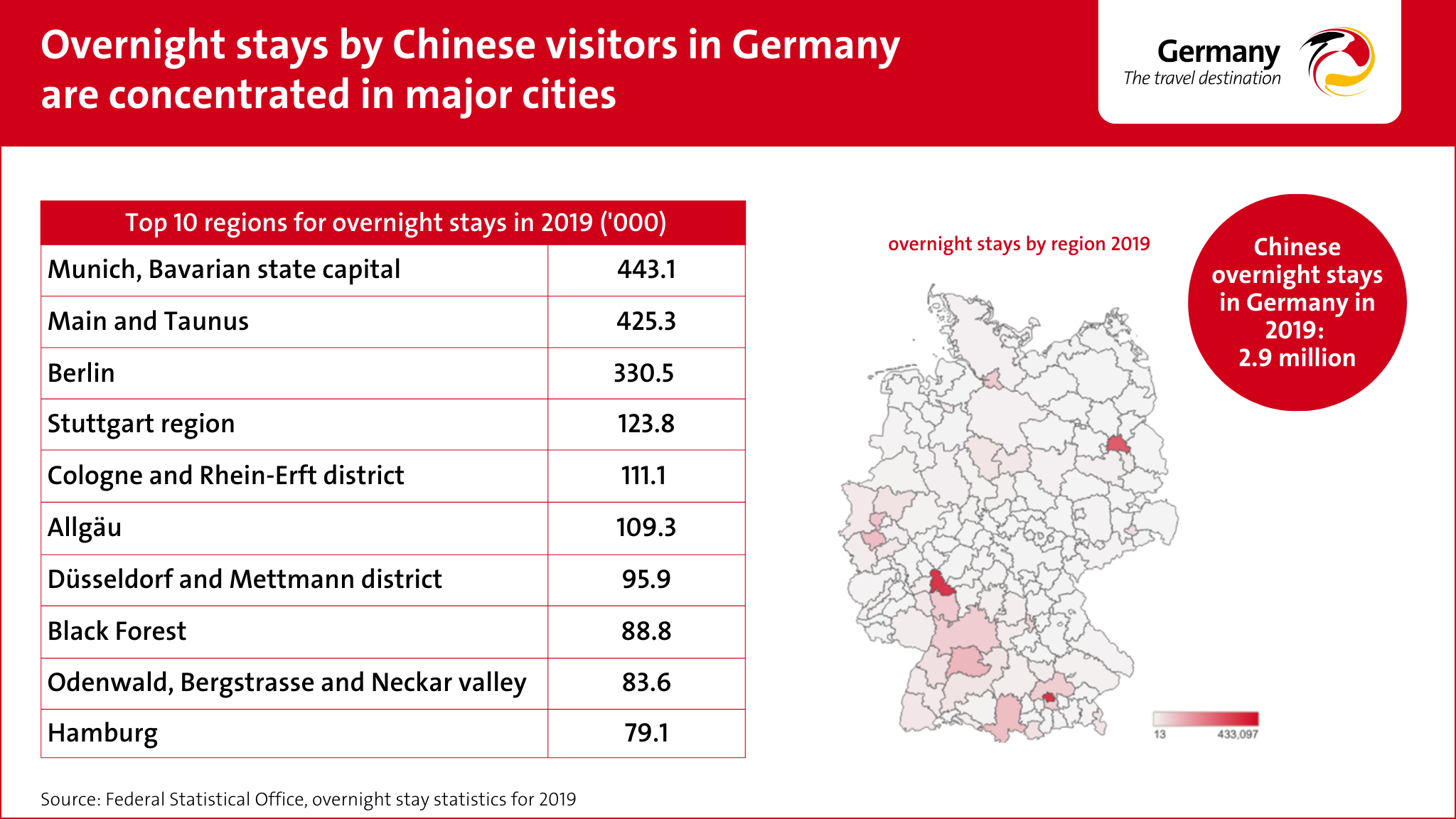

In the 2010s, Germany became the most popular travel destination in Europe for Chinese visitors. The volume of overnight stays tripled from 0.82 million (2009) to 3.02 million (2018). Accounting for 3.4 per cent of the market, China was the 12th biggest source market for inbound tourism to Germany.

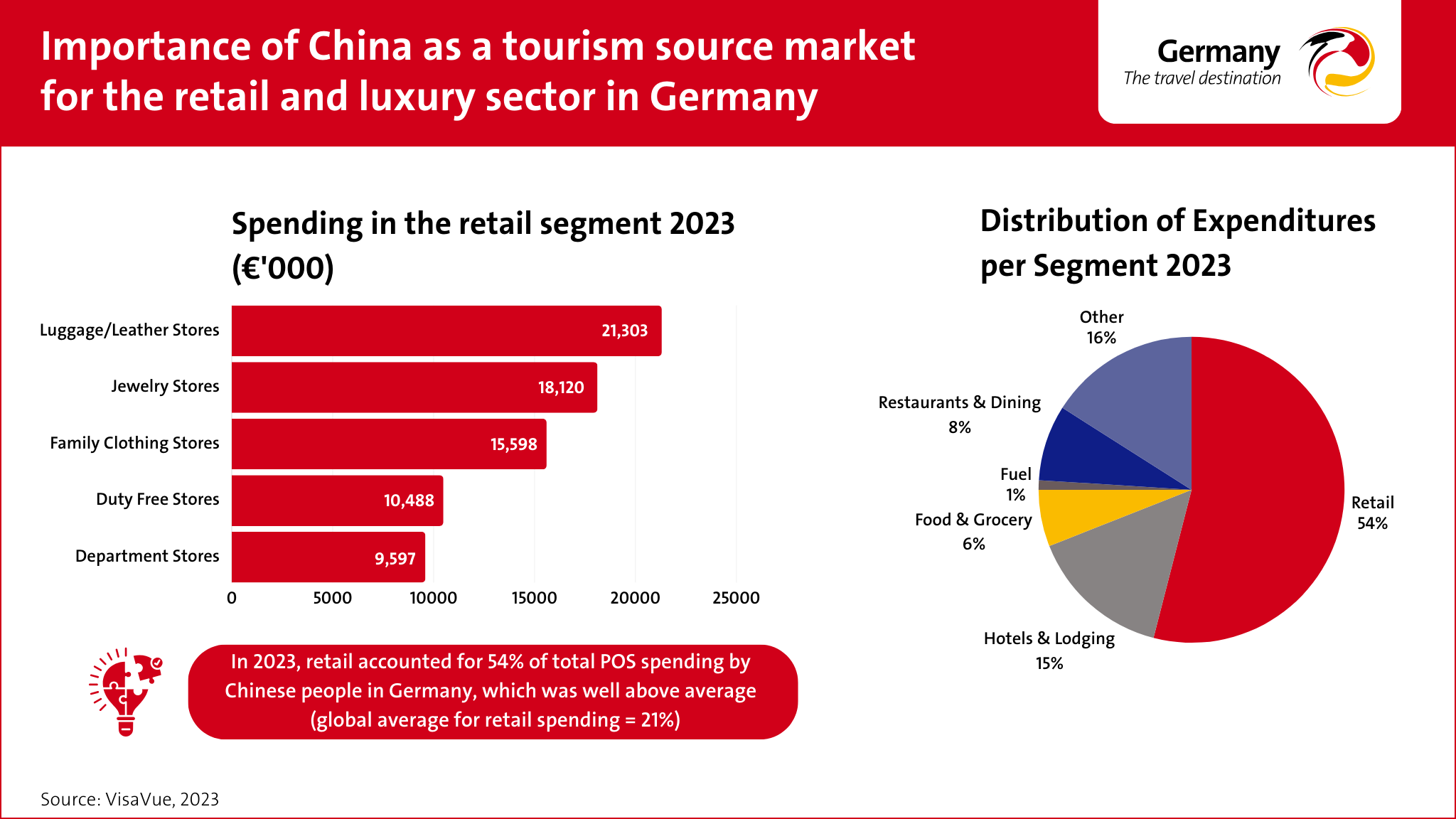

In more good news for the retail and tourism and leisure industry in Germany, the Chinese are also high spenders. Indeed, Chinese visitors to Germany spent a combined total of €6 billion on their travels in 2019. In terms of revenue, this puts China in second place out of all source markets for inbound tourism to Germany.

China is even more dominant when it comes to tax-free shopping. Of the €1.32 billion spent on German tax-free retail in 2019, 40 per cent was attributable to visitors from China (1st place), followed by Russia (2nd with 12 per cent), and Switzerland (3rd with 7 per cent).

3. A melting pot of cultures – factors in Germany’s success as a travel destination

China’s huge growth potential is not the only thing that sets it apart from other source markets. The way in which Chinese visitors travel, how they experience culture and activities on trips, and their expectations for their trip to Europe all need to be considered in our tourism offerings.

For example, in 2023 just under a quarter of Chinese tourists booked multi-destination tickets allowing them to visit several countries on their trip to Europe. With so much on offer across the continent and in light of the growing competitive pressure, it is therefore all the more important that the unique strengths of Germany as a travel destination are clearly identified and highlighted for its potential customers.

But what specific strengths should be highlighted? According to the European Travel Commission, for example, Chinese travellers rate safety, the quality of the tourism infrastructure and world-class attractions particularly highly when choosing a destination.

As part of our Quality Monitor survey of the German tourism industry, we ask international guests about their trip to Germany while they are still in the country. In the most recent survey, the most popular reasons for choosing Germany cited by Chinese visitors were by far local attractions (68 per cent), followed by townscapes/architecture and arts/culture. It also found that Chinese travellers visiting Europe are still staying overnight mainly in major cities and urban centres.

Given the status that Chinese people attach to long-haul travel, retail experiences are especially important. This means that China as a source market plays a key role for the retail and luxury sector in Germany. But the shops and stores have needed to adapt to meet this demand. And, in fact, many of them now offer Chinese-speaking guides, an international delivery service, web content and even Chinese-friendly food and drink.

Personalisation is gaining traction among Chinese tourists and is one major trend that was frequently mentioned during our Digital Travel Knowledge tour. Instead of offering fixed itineraries for large groups, tours are being tailored more and more to the participants’ personal interests. There is strong demand for visiting major events, with the online travel agencies reporting lots of enquiries from China for EURO 2024, for festivals or for concert appearances in Germany by international stars.

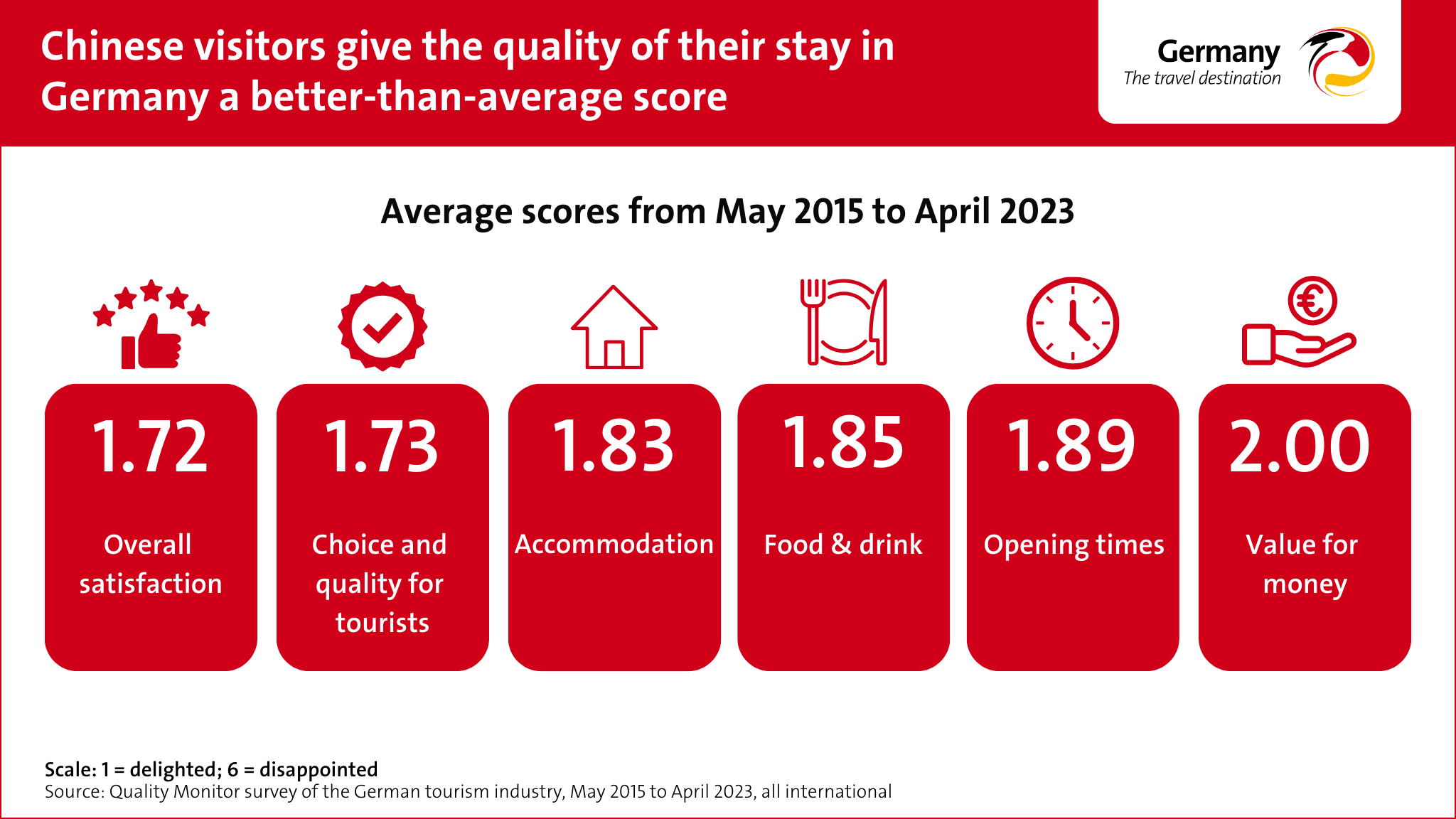

Germany’s offering for tourists meets Chinese visitors’ expectations and has done for some time now. According to our Quality Monitor survey of the German tourism industry, their level of general customer satisfaction over the period May 2015 to April 2023 was 1.72 – higher than the average for visitors from all countries (1.83). When asked more specifically about the variety and quality of the offering, about the accommodation, food and drink, opening times and value for money, Chinese holidaymakers again gave the quality of their stay in Germany a better-than-average rating.

4. Coronavirus – zero hour for tourism and a definitive restart

In 2020, the pandemic clearly exposed the fragility of global travel patterns. Within a few weeks, almost all travel from China ground to a halt, and with it the entire tourism industry worldwide.

The Chinese outbound tourism industry proved to be resilient, despite extensive travel restrictions. In an autumn 2020 survey conducted by IPK International on behalf of the GNTB, 44 per cent of Chinese respondents indicated a desire to undertake outbound travel again, with 25 per cent wanting to travel to Germany in the next 12 months.

At the GNTB, we decided at the time to continue with our marketing activities in the country. A roadshow with stops in Beijing, Shanghai, Chengdu and Guangzhou reached around 50 to 70 Chinese participants at each venue. Strict safety and hygiene precautions were observed at the fully offline, in-person events. As I said about that strategy here in this blog in 2020, “If we want to entice Chinese tourists to get on a plane and travel any time soon, we must be prepared to ‘show our face’ locally.”

The pandemic flaring up again put paid to any rapid recovery, but the GNTB’s local presence was still highly appreciated by the Chinese travel industry. In fact, in recognition of our excellent performance during the COVID-19 pandemic, we received the China Travel Industry Award from the leading Chinese trade journals Travel Weekly China and M&C China in 2021.

Travel restrictions only began to be gradually relaxed and travel opened up from 2023. This was initially for business travellers from January, then for private individuals from May and finally for group travellers from September.

5. Analysis: China as a source market today

In the post-pandemic era, Germany – along with France and Italy – is once again among the top destinations that Chinese people would like to visit on their next trip to Europe. The Chinese market accounted for 1.3 million overnight stays in Germany in 2023, meaning the rate of recovery compared with pre-pandemic figures was already at 45 per cent.

Germany can build on a long-standing reputation as a travel destination. More than two-thirds of its tourists from China in 2023 were repeat visitors, with 28 per cent having been to Germany four or more times.

Longer stays make a sizeable contribution to reducing the per-day carbon footprint of Chinese visitors’ trips to Germany. So it’s pleasing to report that their average length of stay had risen from 11.9 nights in 2019 to 18.0 nights in 2023.

The groundwork has been laid for the recovery to continue and to do so strongly. In the first quarter of 2024, the number of flights from China to Germany reached 86.6 per cent of the pre-Covid figure from 2019, with the increase in the supply of flights enabling this rapid growth. The recovery in arrivals in the first quarter stood at 48.8 per cent and had reached 62.2 per cent by April 2024 (Forward Keys).

6. Understanding the source market better – exclusive survey by Sinus Institute on behalf of the GNTB

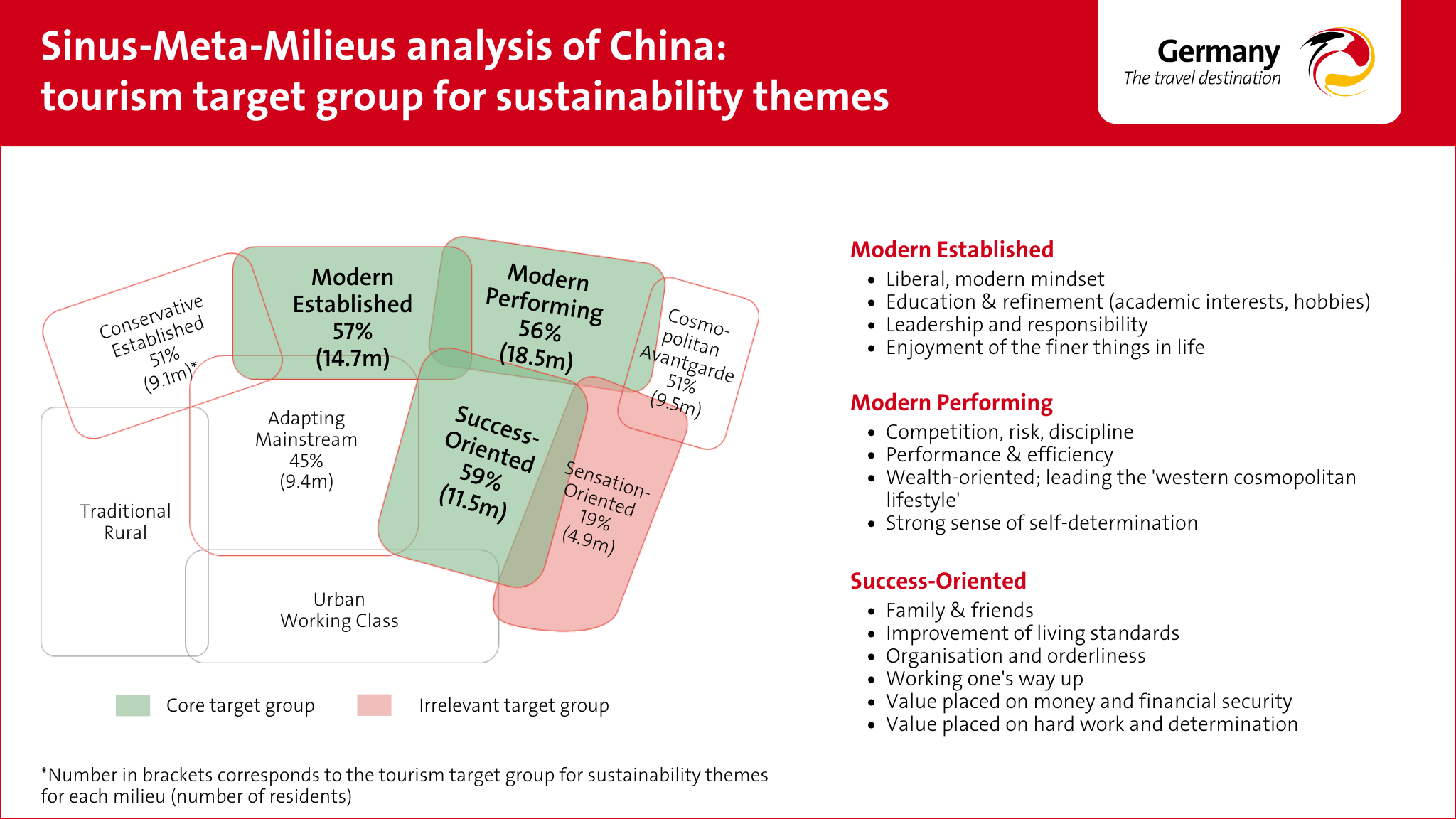

It would be very short-sighted to reduce Chinese travellers to sightseeing and shopping. Indeed, Chinese tourists are also showing an increasing interest in landscape/scenery and sustainability. We commissioned the Sinus Institute to undertake an exclusive analysis of lifestyle ‘milieus’ in the most important urban centres in China – where the vast majority of its international travellers come from.

This revealed that there was an above-average interest in sustainability in the key milieus of Modern Established, Modern Performing and Success Orientated. According to the study, 48 per cent of those surveyed attached particular importance to sustainable travel, and 77 per cent said they would also like to focus on nature during a city break.

The second major aspect for understanding the market better and honing our strategy is to consider that everyday living in China is already far more digital than we can imagine. The Internet Core Trends Annual Report 2023 by Quest Mobile reports that there are more than 1.2 billion monthly active users (MAUs) of mobile internet solutions and 980 million MAUs of ‘mini-programmes’ from various platforms. The time spent on various networking apps in China stands at 160 hours per month. The figure is 104 hours for Germany. The report estimates that there are 284 million MAUs for smart homes, 129 million for portable smart devices and 70 million for intelligent cars.

7. Technology and tourism – early adopter from the Far East

Digital transformation is fuelling the growth of the Chinese economy. Moreover, a wide variety of global trends abound in China, such as the availability of affordable digital gadgets and the implementation of digital solutions in everyday life. From Alipay to autonomous mobility, digital services are omnipresent.

Chinese digital companies – including the Alibaba Group, Huawei, Xiaohongshu, Shanghai Data Exchange, JD.com and Tencent – are setting standards as manufacturers, trading platforms and communication service providers on the global stage. Trip.com Group, Meituan-Dianping, DJInnovations, PonyPilot and others can be found at the various touchpoints along the entire tourism value chain, from inspiration and retail to transport services.

During our talks with representatives from these leading tech and tourism companies, we have seen sophisticated strategies for an individualised, digitalised, and AI-based customer journey. By heavily using innovative technologies, particularly in the fields of AI, IoT, big data and robotics, these companies are influencing not only the Chinese travel market but also the links to the international destinations visited by Chinese tourists.

This is yet a further sign that the future success of tourism lies in monetising data and focusing on innovation. The next steps now require all players in the German tourism sector to play their part.

8. Digitalisation as a service concept

Digital transformation is opening up an increasing number of opportunities to make travel even more convenient and memorable. A key aspect of this is expanding the range of services, such as adding mini-programmes within bigger apps. In China, these ‘apps-within-an-app’ operated by a variety of platforms are now notching up 980 million active users per month.

Chinese tourists have long been using mobile payment apps for much more than simply making payments as the apps give them access to other convenient services too. For example, Alipay customers receive destination recommendations from the platform both before and during their trip. The app is also a frequently used means of communication among Chinese people.

In recent years, the GNTB has launched a variety of campaigns in the Chinese market, including with the online travel company Trip.com Group and the payment service Alipay. The global influencer campaign #AMAZING Journey in Germany, which was run in cooperation with Huawei, was rolled out on the social media channels Instagram, Facebook and Weibo. And lifestyle icon Jason Chan visited Germany for the digital GNTB x Leica campaign.

Back in 2020, the GNTB introduced an official WeChat mini-programme and later developed a chatbot within the app. Since the end of 2023, the GNTB has been working with Baidu to train the latter’s AI chatbot service Wenxin Yiyan (Ernie Bot) with the aim of creating a personalised AI assistant for travel in Germany. To coincide with EURO 2024, the GNTB is inviting a number of Chinese influencers to visit Germany and use the AI assistant to help them.

We are now taking further steps under this approach:

- During our China Digital Travel Knowledge Tour, for example, we signed a memorandum of understanding with the Trip.com Group.

- We are also intensifying our long-standing partnership with Alipay.

- In the post-coronavirus era, we are evaluating the current market share of the various channels used for our campaigns in the market, including WeChat, Trip.com, Xiaohongshu and Weibo.

- Furthermore, we are looking at Destination Germany’s current content on Chinese platforms to identify whether any of it needs to be adapted for specific target groups.

- Alongside the #GermanySimplyInspiring brand communication, targeted sales formats are required on the most influential platforms, such as live streaming formats or ‘German weeks’ with packaged special offers from hotels, restaurants and cafés, retailers and leisure facilities.

- A special brand ambassador (mascot) could well be a good idea for the Chinese market.

- Another focus is artificial intelligence. AI influencers, in particular, have been prevalent in Chinese online media for some years. It is important that relevant content on Destination Germany is made available to these brand ambassadors.

9. Conclusion

In the European Travel Commission’s Long-Haul Travel Barometer from January 2024, Germany was once again among the top three European destinations that Chinese people would like to visit on their next trip abroad. With multiple answers permitted, 65 per cent of respondents indicated France as a preferred destination, followed by 33 per cent for Italy, 31 per cent for Germany, 25 per cent for Switzerland and 19 per cent for Denmark. The UK, the Netherlands and Austria each achieved 18 per cent. This underlines both the strong popularity of Germany as a destination and the stiff competition that it faces from other European countries.

A seamless process for visa applications is required if this market potential is to be harnessed. In the first quarter of 2024, seating capacity on flights to Germany stood at 91 per cent of the volume recorded in the comparative period of 2019. And while the number of flights from China to Germany in the first three months of this year was at just 48.8 per cent of the pre-pandemic level, the figure shot up to 62.2 per cent in April.

Appetite for travel will also receive a boost from the 4.9 per cent growth in Chinese gross domestic product that the OECD is forecasting for 2024.

One thing is clear: our GNTB China Digital Tour marks the start of a new, post-pandemic approach to marketing aimed at Chinese visitors. Working with the German travel industry, we must ensure that Germany maintains its competitiveness and ability to make up ground in the most important Asian source market.

The major trend in the Chinese market is the further individualisation of travel behaviour on the basis of digital technologies. As outlined above, we will continue to step up our direct customer communications by introducing targeted marketing activities and new B2C formats. In addition to extensive press work, this will include the use of specific Chinese social media channels.

Tourism and technology are rapidly becoming more and more entwined, and we have already put the necessary infrastructure in place with our GNTB Open Data/Knowledge Graph project. We can now supply Chinese AI chatbots with up-to-date tourism data for Destination Germany. Using our existing and new relationships with major tech companies, we will work together to put the strategic building blocks in place.

We invite everyone in the German travel industry to join forces with us to write the next chapter in the story of success for German inbound tourism.

Yours,

Petra Hedorfer