Reports on how the coronavirus pandemic

Reports on how the coronavirus pandemic is developing seem to change by the hour at the moment. The German government’s intention to extend financial support for tourism companies and provide further sector-specific aid is therefore a welcome signal in times like these.

Many companies in the industry are heavily reliant on these measures, as the recovery scenarios we had so far envisaged have already been overtaken by events.

The analyses of the current situation are sobering, but ultimately they are the starting point for all strategic and operational approaches to finding ways out of the crisis.

Our ongoing mission is to maintain the strong image our customers around the world have of Germany as a travel destination, and to provide the expertise, up-to-date market analysis and effective marketing activities that will enable our partners in Germany’s tourism industry to make a fresh start.

The latest Anholt Ipsos Nation Brands Index has once again confirmed Germany’s excellent image with a no. 1 ranking. It should be noted that the survey of 20 countries was conducted between 7 July and 31 August, i.e. in the midst of the pandemic.

Last time, I presented a broad analysis of the previous weeks’ developments.

Today’s update focuses on some important overseas markets for inbound tourism to Germany, which I would like to look at in more detail with you now.

But why talk about overseas markets at all at this time? Should the GNTB not be focusing its activities on European markets because the prospects for a recovery in tourism are much better here, particularly from our neighbouring countries?

It is true that Europe has been the main source market for inbound travel to Germany in recent years, with a market share of 72 per cent. The number of overnight stays and the revenue generated by European visitors have been a cornerstone of Germany’s strong position in the international market.

But it is also true that many overseas markets have shown considerable potential, especially at the beginning of the last decade. Destination Germany generated high growth rates and gained new customers in Asia and South America, in particular.

In view of the shift in global economic growth that has become apparent in the last two to three years, and of the geostrategic and geopolitical changes in the world order, many market players are asking themselves how they can regain the growth from high-potential overseas markets in the medium term.

To achieve this, we have to research the markets in detail. We can then formulate marketing strategies that are sustainable in the long term and use the expertise gained to support our partners in Germany’s inbound tourism industry.

The USA – great again after COVID-19?

Before the pandemic, the USA was by far the most important overseas market for our inbound tourism industry, with around 7 million overnight stays and a market share of 7.8 per cent of all international overnight stays in Germany. It is recovering very slowly according to the latest analysis by Tourism Economics (TE). The number of overnight stays this year will be more than 60 per cent below the previous year’s level. This figure could improve slightly next year to just over 50 per cent lower, while the figure is expected to be 32.6 per cent below pre-pandemic levels in 2022 and 22.4 per cent below in 2023.

Let’s move away from this pessimistic outlook towards a more optimistic one. The US market offers potential for 3.5 million overnight stays in 2021, around 4.7 million in 2022 and 5.4 million in 2023.

Our competitors have also identified this potential, which is why we must remain active during the crisis even if it appears countercyclical.

Between the end of July and mid-September, for example, we rolled out a culinary campaign in collaboration with Condé Nast that generated more than 600,000 impressions.

A further campaign under the banner ‘Dreams become reality’ is aimed at the target group of high-earning baby boomers. By working with the online platform of the American Association of Retired Persons (AARP), which reaches more than 12 million people every month, we will be able to generate 5.7 million impressions within a few weeks. The campaign will start in mid-November.

We recently held our annual US Advisory Board Meeting, though this time as a virtual event. Around 140 partners from German travel companies, destination marketing organisations and other tourism service providers had the opportunity to talk directly to senior managers from tour operators, associations, Lufthansa worldwide, Rail Europe, the TripAdvisor travel platform and the American Tour Operators Association (USTOA) to get an American perspective on the current development of demand.

Terry Dale, President of the USTOA, reported that 57 per cent of their affiliated companies have customers who have postponed trips booked for 2020 to 2021. US tour operators expect demand to grow significantly in the fourth quarter of 2021, in particular.

The webinar for the Advisory Board Meeting is available here.

This positive mood is supported by new findings from exclusive market surveys commissioned by us.

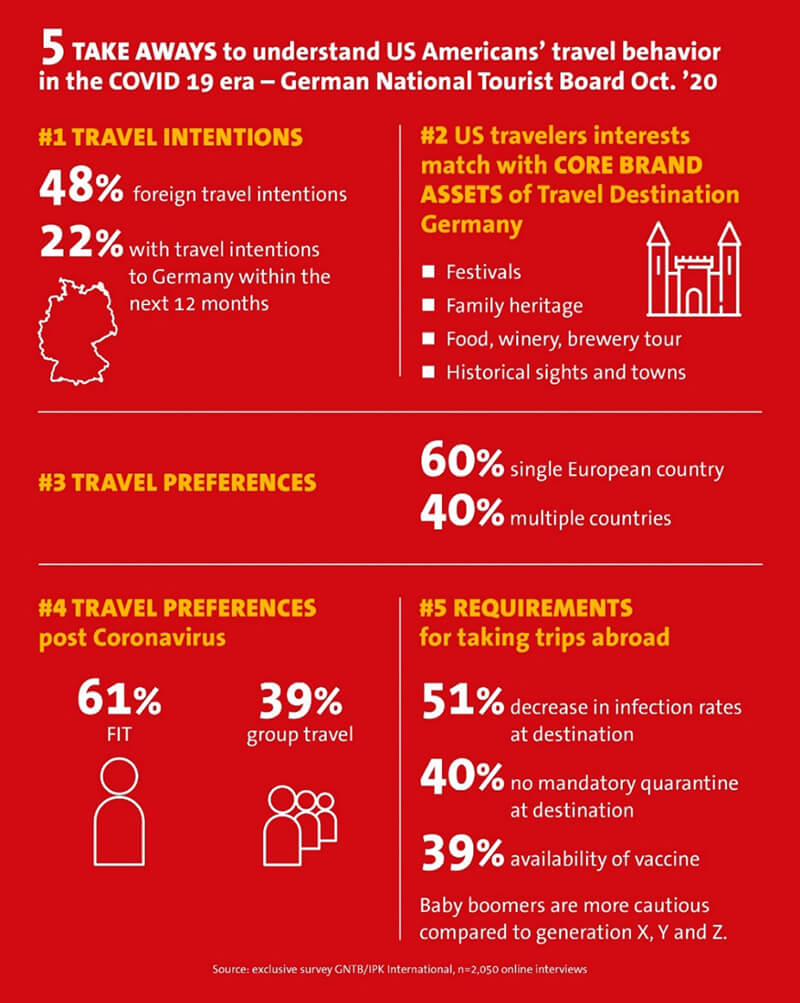

IPK International, for example, found that there is a clear upward trend when it comes to people’s intention to travel abroad. In the initial round of interviews at the end of May, 41 per cent of Americans still intended to travel abroad in the next twelve months, but by the end of September this figure had risen to 48 per cent. 22 per cent have plans to travel to Germany next year.

The main areas in which Americans’ general travel interests overlap with what they associate with Germany are: visiting festivals and events such as the Oktoberfest and the Oberammergau Passion Play, exploring family heritage, enjoying food, going on wine and brewery tours, and visiting historical sites.

While Americans often tour multiple countries when they travel to Europe, 60 per cent currently say that they would focus on visiting one country for now. This represents both an opportunity and a challenge for Destination Germany in the European travel market.

Asia – large markets with significant potential

Previous crises have highlighted that Asian countries overall are much more wary of crises than other source markets for global tourism. Little surprise then that coronavirus had the biggest impact on travel intentions in Asia, according to the initial round of interviews conducted by IPK International in May 2020. Only 29 per cent of respondents still intended to travel abroad in the next twelve months. By October, this had increased by around a third to 38 per cent. We can see that the direct influence of the virus on travel intentions is diminishing, but scepticism is still much more pronounced than among Americans and Europeans.

China – setting the pace for travel

The example of China illustrates the complexity of the recovery processes in specific markets. Here, where the first coronavirus cases were recorded ten months ago, the subject has now largely disappeared from public debate. Economic growth is strong, which increases purchasing power and the appetite for travel and spending.

While infection rates are rising rapidly in many European countries, hundreds of millions of people in China travelled throughout the country during the ‘golden week’ around the national holiday in October. It is only a question of time, and of opportunities such as flight connections, before travel abroad will pick up again.

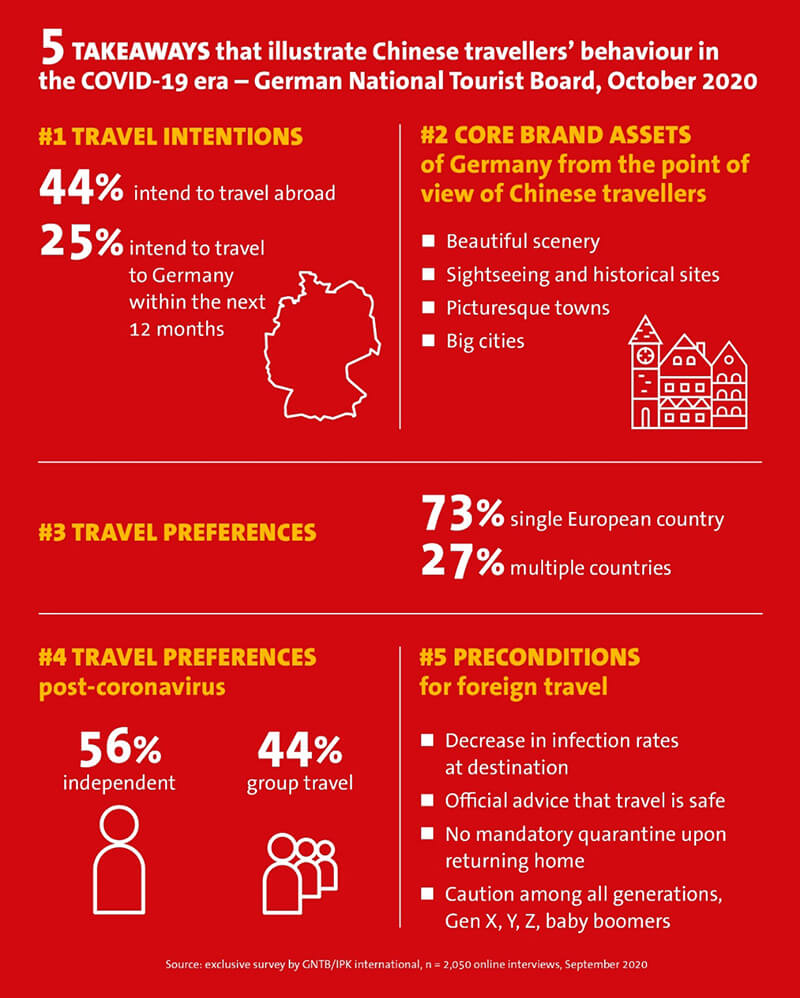

That is why we commissioned IPK International to conduct a second round of interviews on the travel intentions of the Chinese, following the first survey in May. The latest survey from October clearly shows that the desire to travel is increasing. While only 32 per cent of respondents in May had plans to travel abroad, this figure rose to 44 per cent in autumn. In the first round of interviews, 16 per cent said they had plans to travel to Germany in the next twelve months, but by the second round this had increased to 25 per cent. Chinese people associate Germany with beautiful scenery, sightseeing and historical sites, picturesque towns, big cities and exceptional architecture, plus superior shopping and museums and exhibitions.

This is also reflected in Tourism Economics’ forecast, according to which China could once again contribute more than 3 million overnight stays to inbound tourism in Germany by 2023, a 6.1 per cent increase on the pre-crisis levels in 2019.

However, Chinese tourists’ long-haul travel plans are still hampered by drastically reduced flight capacity. The recovery process will essentially be determined by a balanced increase of both supply and demand.

To strengthen the demand side, we are organising a roadshow in November with stops in Beijing, Shanghai, Chengdu and Guangzhou, each with 50 to 70 Chinese participants. These will be workshops with strict safety and hygiene precautions, but in person and face to face. I believe this is a very important signal to send. If we want to entice Chinese tourists to get on a plane and travel any time soon, we must be prepared to ‘show our face’ locally. The GNTB and its team will continue to represent Destination Germany in the market during this period.

Our digital activities in China included a range of live streaming formats, such as virtual sightseeing tours and online cooking courses. The live content was placed on various market-specific platforms, including Mafengwo, Sina Weibo and Meituan-Dianping. We will continue these campaigns in 2021.

Japan – appetite for travel is returning slowly

The analysts believe that the Japanese market, which over the past decade has seen modest average growth of 2.6 per cent, offers potential for a significant recovery over the next three years. According to Tourism Economics, Japan could account for 1.25 million overnight stays in Germany in 2023, a rise of 4 per cent on 2019.

Our colleagues in Tokyo are using all channels to promote Germany as a travel destination. For example, 61 media representatives have just attended the virtual annual press conference. In November, we will be attending the Japan-Germany Industry Forum alongside Germany Trade & Invest and the worldwide network of German chambers of commerce. And in early December, Germany will be the focus of the B2B webinars hosted by the Japan Association of Travel Agents. Also in December, an offline trade event with no more than 35 key tour operator customers and media representatives will take place for the first time in a while, and a cross-media empathy campaign for Christmas will be launched in the coming weeks.

Quality tourism is an essential part of Destination Germany’s DNA. High-quality offerings, customer focus, excellent service and a distinct identity are characteristics with which we can score points in the international market, especially now. That is why we have decided to take part in the virtual ILTM (International Luxury Travel Mart) World Tour. We are specifically using two modules of this high-calibre platform to promote our offering for the US market and China/Hong Kong in one-on-one meetings.

Clearly, the coronavirus pandemic will influence our work for a long time to come. But it is also clear that Destination Germany has a good chance of emerging from the crisis even stronger than before. We are optimistic this will happen as long as we continue our efforts to position our strong brand in the markets.

Stay safe, and stay in touch

Petra Hedorfer